Deep Read:

GLP-1: Wonder drug and social disruptor?

How GLP-1 drugs could change your business...... →

For general enquiries please contact us on

+44 1223 248888

enquiries2026@innoviatech.com

St Andrew's House, St Andrew's Road

Cambridge CB4 1DL United Kingdom

FIND US

“Nothing can be said to be certain, except death and taxes.” Benjamin Franklin, 1789

Whilst the former is still true, any certainty around the latter seems misplaced. The unpredictable imposition of global tariffs (taxes by any other name) has caused significant turbulence. And it’s not just tariffs. We are all feeling uncertainty from many other factors – global wars, rises in inflation, increased personal debt and the impact of AI on jobs, to name a few.

Not surprisingly, persistent levels of uncertainty mean that people find it hard to plan for the future because they cannot easily weigh up the risks when making decisions and hence, they cannot plan ahead. Inevitably, management of this uncertainty produces various emotional and behavioural responses.

We are seeing this play out across a wide range of categories and geographies. Consumers are changing their buying behaviour in various ways in response to high levels of uncertainty.

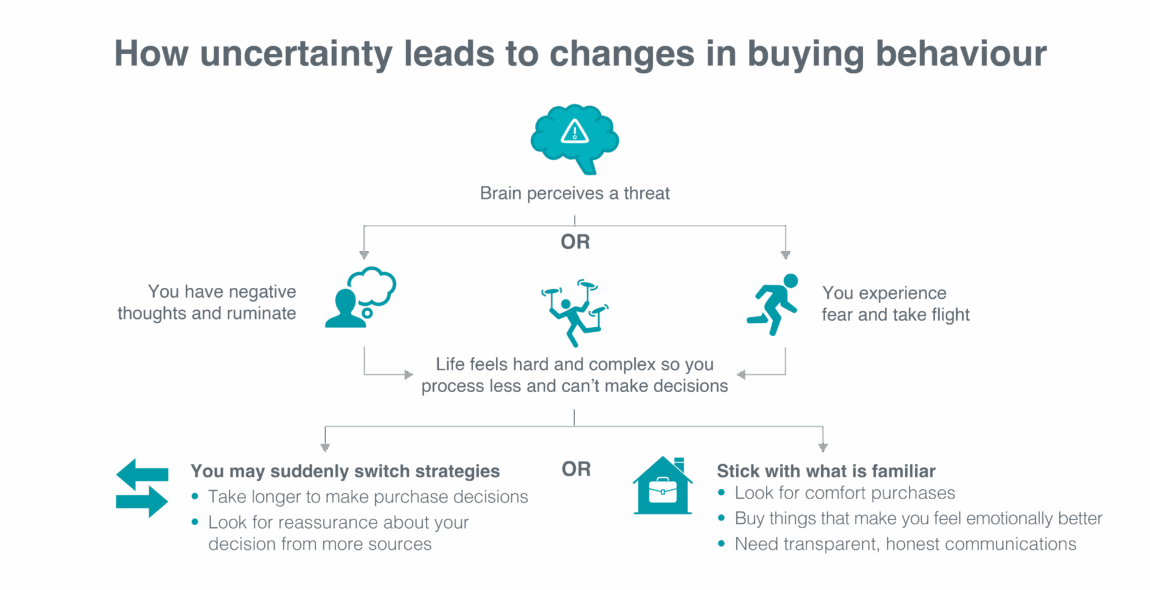

First, let’s look at what happens to your brain when faced with persistent uncertainty or a threat. There are two different routes to anxiety in the brain:

But how do these types of response affect our behaviour? As we have said, persistent (sustained) uncertainty results in stress and anxiety which can hinder your ability to cope effectively. This is because it impairs executive function, which is required for decision-making, self-control and taking initiative. Uncertainty might cause you to function in power-saving mode and put less effort into activities outside of what is absolutely necessary. It can lead to reduced resilience so that if you are faced with personal challenges you find it harder to navigate difficult situations. You may find that you are reluctant to take action to information that seems uncertain. “When life is too much, people process less” (Reynolds 2020).

Unexpected uncertainty can cause people to hastily switch their strategy when they may have been better off sticking to their previous behaviour. We saw this when people started to stockpile toilet paper in response to the COVID crisis. But when faced with gradual uncertainty that builds over time, people tend to stick to their current strategy as they are less aware of the threat or potential harm. We see this in the way that people are reluctant to respond to the effects of climate change. We’re also more likely to make poorer decisions, by over-estimating risks (i.e. catastrophizing) and missing opportunities to act in our best interests (e.g. loss aversion is linked to the gender gap in financial investments).

The imposition of tariffs that lead to increased prices and inflation is an example of the combination of both types of uncertainty – unexpected and gradual. This may explain why we are starting to see some surprising divergence in behavioural responses.

In times of uncertainty, people often seek the comfort of the familiar and nostalgia such as buying food that reminds them of their childhood. They may focus on appearance and health as a coping mechanism to address deeper emotional issues and to gain some control and reassert their identity; a strategy which could underpin the seemingly counterintuitive increase in sales of lipstick!

People may take longer in the research phase of making a purchase because they are looking for reassurance from multiple sources and want to be sure that what they are buying will have value in the long term. Moreover, they deliberately seek certainty by looking for transparency and honesty in corporate communications.

But these responses are not uniform: they vary demographically, sectorally and geographically. At Innovia we work across a wide range of categories, and we have observed that changes in consumer beliefs and behaviour are playing out in intriguing ways. We are seeing the emergence of the bimodal consumer and a divergence in responses between the USA and Europe.

European and North American consumers are responding differently because there are different conditions of uncertainty and different sources of change for each geography.

In the USA, we are seeing a confluence of indicators that are contributing to consumer uncertainty. Inflation is accelerating, the GDP growth rate was down in quarter one (though rebounded in the second quarter due to reduced imports) and hiring rates are slowing. The consumer price index shows an annual increase in costs for food (especially food out of home), electricity, medical care, airline fares, recreation, household furnishings and cars.

It is not surprising that the top three causes of concern for US consumers according to the McKinsey Consumerwise Survey are rising prices and inflation, tariff policies and the ability to make ends meet. Conference board data shows that nearly 70% of USA consumers think that a recession is very or somewhat likely in the next 12 months. Sixty percent of consumers say they have already changed or expect to change their spending habits because of tariffs, and more than half expect to cut back on non-essential spending. In fact, according to the Yale Budget Lab, the impact from all 2025 tariffs is that prices will rise by 1.8% in the short run, the equivalent of an average household income loss of $2400. USA consumers have plenty to ruminate about.

In contrast, European consumers are much less gloomy. Levels of optimism about the economy remain stable, especially in Spain where economic growth outperforms the Eurozone. The top three causes of concern for European consumers are rises in prices/inflation, international conflicts and climate change. Only 11% cite the impact of tariffs as a concern. There is an expectation that there might be a change to spending habits due to price rises and inflation, but this is lower than for the USA. On balance, consumer household finances in Europe are stable and the result is that there has been a slight uptick in both discretionary and non-discretionary spending, especially in some categories such as baby supplies, fresh produce, fitness, travel-related activities and petrol.

When consumers change their behaviour, different sectors are impacted in different ways. When times are uncertain, consumers often make more intentional and risk-averse purchasing decisions. And when consumers change their behaviour, this affects different sectors in different ways.

But there are some sectors that thrive when times feel uncertain. Home improvements, cosy apparel, and wellness-focused products all benefit as consumers seek to allay their anxiety by retreating into the safety of their homes and look for ways to feel good about themselves.

Health care is also a sector where consumers are unwilling to compromise and where brands can continue to thrive. Over-the-counter medicines and contact lenses are good examples of where consumers are less willing to trade down, though they may try to space out their purchases for as long as possible. In this sector, the perceived cost of switching is high (e.g., bothersome symptoms and decrease in quality of life), and in an environment where competitors have also raised their prices, brand loyalty remains strong.

Other sectors, however, are seeing a drop in brand loyalty and an unwillingness to pay the increased costs to cover tariffs and issues in the supply chain. This is the case for the beauty sector, food sector, and for apparel.

As tariffs are a regressive tax, particularly in the short term, tariffs disproportionately affect people of lower socioeconomic status. This means that the US 2025 tariffs are projected to burden the second decile 2.5 times as much as the top decile. A recent TIME article (April 2025) described the emergence of ‘bimodal consumers’ in the USA: affluent consumers continue to spend on premium goods, while low- and middle-income households are disproportionately impacted by rising costs and tariffs. This divide is driving polarised (bimodal) consumption patterns, with some trading up for long-term value, while others cut back on essentials.

It is clear that uncertainty is not felt equally and there is a divergence in coping strategies between income groups. People with less disposable income are impacted most by economic uncertainty and feel the need to make more trade-offs. People with more disposable income experience less disruption and can continue to make buying decisions in much the same way as they did before.

For those groups in the USA that are most affected by tariffs, consumers are cutting non-essentials, delaying purchases or trading down to cheaper brands. People most affected by tariffs tend to stop spending on non-essential and reduce impulse purchasing.

Some consumers are prioritising durability, functionality and long-term benefits including in categories such as beauty and personal care. Durability and value can seem at odds with each other. People are faced with having to decide what matters most and make trade-offs. Many consumers are abandoning brand loyalty in favour of value brands, especially in categories hardest hit by tariffs and supply constraints such as electronics, clothing, vehicles, food and alcohol. Gen Z and millennials are leading the shift to secondhand markets and DIY.

In Europe, there have been minimal shifts in spending patterns in the top 5 markets of UK, Spain, Italy, Germany and France.

Under conditions of uncertainty, consumers are more intentional and risk-averse when making purchasing decisions.

The level of uncertainty in the global economy is unlikely to change any time soon. Thus, the changes to consumer behaviour we have discussed are likely to continue for the foreseeable future. Here are three suggested approaches to deal with changing consumer behaviour.

1. Review consumer segmentations

Now is probably a good time for consumer-facing companies to review the consumer segmentations they have relied on for the past decade. Consumer needs and jobs to be done are changing, target profiles may alter, and products may need to change to reflect their changed needs. In fact, it may be necessary to segment by response to uncertainty not the usual demographics and brand loyalty. For example, you may need to work out where consumers are taking the time to consider a purchase decision for longer and where mental shortcuts are being relied upon more because these two things seem to be in tension.

2. Rethink how brands connect with consumers

Brands in particular need to fight back as consumers trade down to cheaper value alternatives. We have seen that consumers have a greater desire for control in uncertain times and brands that recognise this can change how they respond. Nearly half of consumers want to co-create brands: taking such an approach makes it possible for community-driven product development to thrive, especially in categories where authenticity and personalisation are important. New brands such as Gymshark and Drunk Elephant go beyond traditional consumer research methods and actively solicit input from their consumer base to inspire design, improve product ranges and create new sales. Co-creation can be a means to strengthen brand loyalty in a landscape where this is being lost and brands that successfully position themselves as being on the side of the consumer may win out.

Brands that have a heritage and history to fall back on can also benefit as consumers seek the comfort of the familiar. This may be of relevance to food and snack brands that can lean into childhood nostalgia and have formed an integral part of growing up. In fact, there is some evidence that people too young to experience nostalgia can enjoy the certainty and warmth of ‘vicarious nostalgia’. The widespread use of the meme ‘Keep calm and carry on’ and the renewed interest in Friends by Gen Z are good examples of this sort of behaviour.

3. Support consumers’ need for security and certainty

Consumer decision-making overall may be becoming more intentional but splashing out on affordable luxuries to boost mood, enhance personal identity and allay anxieties remains a priority. Lipstick was mentioned as the example for this type of purchase earlier but an even better indicator may be Netflix who continue to increase revenues and subscriptions despite the impact of tariffs on non-USA content. In times of uncertainty, people cut back on big-ticket items before they cancel their entertainment subscriptions. What better way to feel less anxious and more secure?

Overall, the rapid changes to the global economy have created persistent levels of uncertainty particularly in North America and for lower socio-economic groups. Consumers are responding in a predictable psychological way in the face of persistent uncertainty by showing signs of stress and anxiety which is making it harder for them to make effective decisions and longer-term plans. Companies that recognise these signs can help consumers to make better decisions by ensuring that products meet their new needs and by maintaining a transparency and honesty in their communications.

Is your company prepared for these changes to consumer behaviour? Let’s talk.

References

Adams, C., Alldredge, K., & Coggins, B. (2025, May 30). An update on US consumer sentiment: In response to tariffs, most consumers plan to adjust spending. McKinsey & Company. https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/the-state-of-the-us-consumer

Adams, C., Alldredge, K., & Kohli, S. (2025, June 9). State of the Consumer 2024: What’s Now and What’s next. McKinsey & Company. https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/state-of-consumer

Alquist JL, Baumeister RF, Tice DM and Core TJ (2020) What You Don’t Know Can Hurt You: Uncertainty Impairs Executive Function. Front. Psychol. 11:576001. doi: 10.3389/fpsyg.2020.576001

Burga, S. (2025, April). How Trump’s Tariffs Will Impact U.S. Consumers. TIME; Time. https://time.com/7273506/trump-tariffs-us-consumer-impact/

Dimitriou, A. (2025, July 23). How brands can build connection without adding to the noise – DEPT®. DEPT®. https://www.deptagency.com/en-uki/insight/build-connection-without-adding-to-the-noise/

Dimitriou, A. (2025, August 6). Tariffs are now a brand issue: what global consumers expect – DEPT®. DEPT®. https://www.deptagency.com/en-uki/insight/tariffs-are-now-a-brand-issue-what-global-consumers-expect/)

Doerer, K. (2025, July 10). How consumers are responding to tariffs — and what CX leaders can do about it. CX Dive. https://www.customerexperiencedive.com/news/how-consumers-respond-tariffs-cx-leaders/752631/)

Elani, G. (2025, June 2). Tariffs: A New Economic Shift and How US Businesses Must Think Beyond Survival. Mintel.com. https://www.mintel.com/insights/consumer-research/tariffs-how-us-businesses-must-think-beyond-survival/?

Euromonitor International. (2020, August 21). Consumers Seek the Comfort of the Familiar. Euromonitor. https://www.euromonitor.com/article/consumers-seek-the-comfort-of-the-familiar

Reynolds, B. (2020, November 2). The science of what uncertainty can mean for your mind and body. University of California. https://www.universityofcalifornia.edu/news/science-what-uncertainty-can-mean-your-mind-and-body

Shafir, E., & Tversky, A. (1992). Thinking through uncertainty: Nonconsequential reasoning and choice. Cognitive psychology, 24(4), 449-474.

The Budget Lab. (2025, April 2). Where We Stand: The Fiscal, Economic, and Distributional Effects of All U.S. Tariffs Enacted in 2025 Through April 2. The Budget Lab at Yale. https://budgetlab.yale.edu/research/where-we-stand-fiscal-economic-and-distributional-effects-all-us-tariffs-enacted-2025-through-april

Sophie recently interned as an innovation consultant at Innovia Technology. Driven to apply behavioural science to shape innovation solutions in business contexts, she worked on challenges spanning medical technology, food and beverage, consumer goods and digital product enhancement. Her approach is grounded in academic interests extending to the intersection of behavioural science and technology, having supported research in Virtual Reality and Digital Health to examine how behavioural insights can aid tech adoption.Currently pursuing an MSc in Applied Psychology and Economic Behaviour at the University of Bath, she is deepening her expertise in behavioural literature and statistical analysis. Her research investigates how misperceptions of social norms contribute to shaping economic desires and how these can be effectively corrected to improve behavioural outcomes. Previously, she graduated from the University of Warwick with a BA in Economics, Psychology, and Philosophy from the University of Warwick, where her dissertation explored ethical concerns around consumer autonomy in nudge practices. She is now focused on continuing to build a career in consultancy, using her human-centred background to ensure commercial solutions keep the people in focus.

Sophie Shaw: LinkedIn

Helena joined Innovia in 2014 straight from a stint working on research to persuade people to be vaccinated for pandemic flu. She is nothing if not forward-looking! Helena was the first Behavioural Scientist at Innovia and over the subsequent decade she developed unique approaches for using Behavioural Science for innovation and built up a team of world-class Behavioural Scientists. Her experience of this can be read in her book Applying Behavioural Science to the Private Sector: Decoding What People Say and What They Do (Palgrave MacMillan)

Helena’s academic background was in social and health psychology but before coming to Innovia she ran an international brand consultancy and worked in advertising and communications. At Innovia, she continues to apply her knowledge to a wide range of sectors ranging across consumer health, fast moving consumer goods, food and luxury goods. Not only has she worked to improve and create new products, but she also acts as a trainer and mentor to clients and colleagues alike on how to use and apply behavioural science to complex challenges. In addition, Helena leads Innovia’s Strategic Advisory Group who act as advisors to the board to help steer Innovia into the future.

Outside of work, Helena is passionate about movement as in her early days she was a ballet dancer. She still does barre classes and is a trained Pilates teacher. So not only could she use her behavioural science to help you make a plan to get fit and healthy, and ensure you stick to it, but she could also teach you how to do the exercises!

Helena Rubinstein: hrr_freshperspective@innoviatech.com

Helena Rubinstein: LinkedIn